Our Story

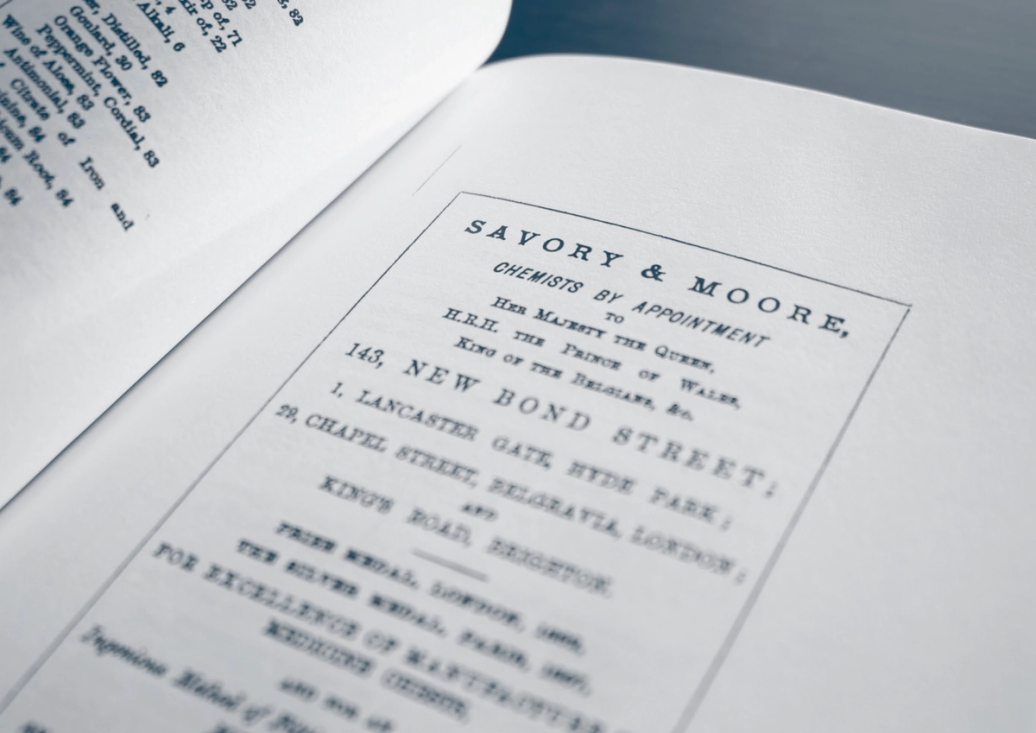

At Savory & Partners, we combine a rich heritage with modern expertise. Founded in 2010 by Jeremy and Helena Savory, our British family company builds on over 200 years of history and is driven by values of trust, professionalism, and excellence.

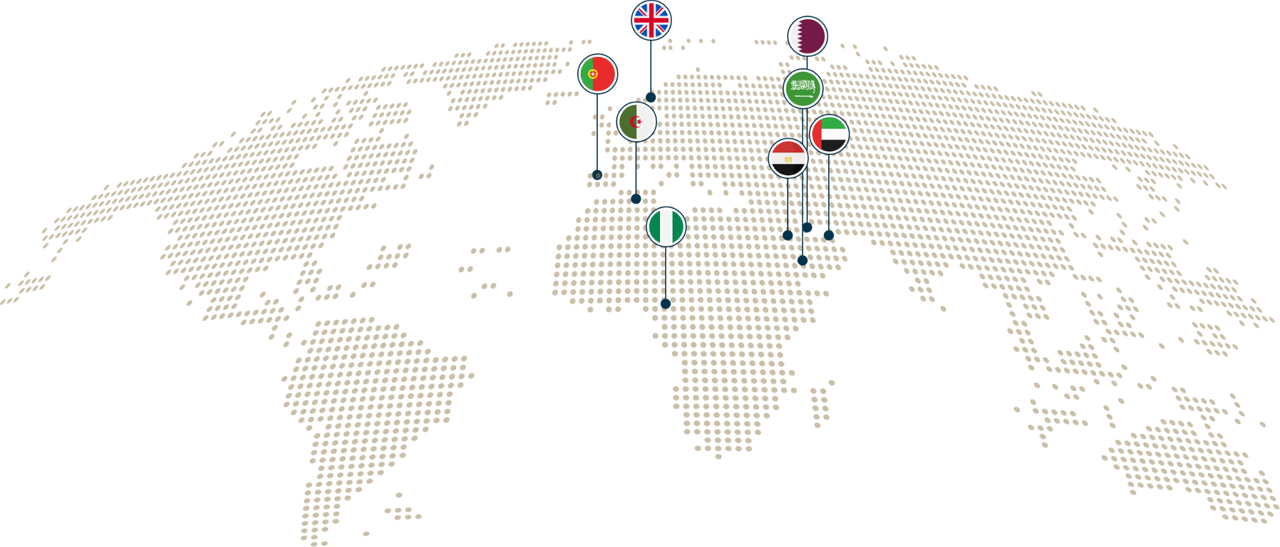

Specializing in EU, UK, and the Caribbean citizenship and residency by investment programs, we empower high-net-worth individuals and families to achieve wealth preservation, asset protection, and legacy planning. As a government-authorized partner with a strong presence in over 20 jurisdictions across three continents, we open access to tax-efficient opportunities and financial security.

Legacy You Can Rely On

Behind every success is a dedicated team of experts working across our global offices. With years of experience and a strong understanding of global wealth mobility, we’ve supported over 11,000 clients in reaching their goals. Entrepreneurs seeking new opportunities, business leaders protecting their assets, and families planning for the future all rely on our trusted guidance, delivered with care, expertise, and a focus on meaningful results.

Savory & Partners is proud to be recognised by Spears 500 as a Top Recommended Firm for exceptional service in Global Mobility and Residence & Citizenship by Investment. Our reputation is reinforced by features in prestigious publications like Business Insider, Conde Nast Traveller, Arabian Business and the Financial Times.

Join us as we set new global wealth mobility and sovereignty standards, helping families secure freedom and peace of mind across borders.

Photo: A Savory & Moore Pharmacy, 143 New Bond Street, Mayfair,London, 1912

Our Story

At Savory & Partners, we combine a rich heritage with modern expertise. Founded in 2010 by Jeremy and Helena Savory, our British family company builds on over 200 years of history and is driven by values of trust, professionalism, and excellence.

Specializing in EU, UK, and the Caribbean citizenship and residency by investment programs, we empower high-net-worth individuals and families to achieve wealth preservation, asset protection, and legacy planning. As a government-authorized partner with a strong presence in over 20 jurisdictions across three continents, we open access to tax-efficient opportunities and financial security.

Legacy You Can Rely On

Behind every success is a dedicated team of experts working across our global offices. With years of experience and a strong understanding of global wealth mobility, we’ve supported over 11,000 clients in reaching their goals. Entrepreneurs seeking new opportunities, business leaders protecting their assets, and families planning for the future all rely on our trusted guidance, delivered with care, expertise, and a focus on meaningful results.

Savory & Partners is proud to be recognised by Spears 500 as a Top Recommended Firm for exceptional service in Global Mobility and Residence & Citizenship by Investment. Our reputation is reinforced by features in prestigious publications like Business Insider, Conde Nast Traveller, Arabian Business and the Financial Times.

Join us as we set new global wealth mobility and sovereignty standards, helping families secure freedom and peace of mind across borders.

1797

Savory & Moore

Pharmacies London, United Kingdom

2008

S&P Real Estate

Real Estate Brokerage & Leasing Dubai, UAE

2010

Savory & Partners

Citizenship Services Group Dubai, UAE

2015

Savory Estates

Real Estate Holdings USA

2020

S&P Consultancy

Private Equity Investments Hong Kong

1797

Savory & Moore

Pharmacies London, United Kingdom

2008

S&P Real Estate

Real Estate Brokerage & Leasing Dubai, UAE

2010

Savory & Partners

Citizenship Services Group Dubai, UAE

2015

Savory Estates

Real Estate Holdings USA

2020

S&P Consultancy

Private Equity Investments Hong Kong

1797

Savory & Moore

Pharmacies London, United Kingdom

2008

S&P Real Estate

Real Estate Brokerage & Leasing Dubai, UAE

2010

Savory & Partners

Citizenship Services Group Dubai, UAE

2015

Savory Estates

Real Estate Holdings USA

2020

S&P Consultancy

Private Equity Investments Hong Kong

1797

Savory & Moore

Pharmacies London, United Kingdom

2008

S&P Real Estate

Real Estate Brokerage & Leasing Dubai, UAE

2010

Savory & Partners

Citizenship Services Group Dubai, UAE

2015

Savory Estates

Real Estate Holdings USA

2020

S&P Consultancy

Private Equity Investments Hong Kong

Why Savory and Partners?

Clients Approved

11,000+

Proven Expertise

15+ Years

Languages spoken

21

Acceptance Rate

100%

Experts

70

offices

8

continents

3

2015: The Honourable Prime Minister of The Commonwealth of Dominica, Mr. Roosevelt Skerrit speaking at a Savory & Partners event

2016: Jeremy Savory and the Honourable Prime Minister of Malta, Mr. Joseph Muscat

2016: Jeremy Savory and the Honourable Previous Prime Minister of St. Kitts & Nevis, Mr. Timothy Harris

2017: Jeremy Savory and the Honourable Prime Minister of Antigua & Barbuda, Mr. Gaston Browne

2023: Helena Savory and the Honourable CEO of St. Lucia CIP, Mr. Mc Claude Emmanuel

2015: The Honourable Prime Minister of The Commonwealth of Dominica, Mr. Roosevelt Skerrit speaking at a Savory & Partners event

2016: Jeremy Savory and the Honourable Prime Minister of Malta, Mr. Joseph Muscat

2016: Jeremy Savory and the Honourable Previous Prime Minister of St. Kitts & Nevis, Mr. Timothy Harris

2017: Jeremy Savory and the Honourable Prime Minister of Antigua & Barbuda, Mr. Gaston Browne

2023: Helena Savory and the Honourable CEO of St. Lucia CIP, Mr. Mc Claude Emmanuel

Additional Services

Our commitment to you goes beyond securing citizenship or residency. We take a unified, agile, and client-centric approach to address your needs as they evolve over time, ensuring you get the most out of your new status while building long-term stability and trust. From managing essential government documents to simplifying financial setups, business establishments, and family additions, our expert team delivers solutions with precision, reliability, and timeliness. It’s about creating lasting value so that no matter how circumstances change, your status remains compliant, and you continue to thrive.

Government Documents

We manage all necessary paperwork and submissions, ensuring you receive the required government certificates for any legal or administrative needs.

Bank Account Opening

We help you unlock the financial freedom of your new passport by assisting with offshore bank account openings, offering greater financial flexibility and security.

Business Establishment

Our expertise simplifies the process of setting up your business. We guide you through acquiring essential government documents and implementing cost-effective strategies for success.

National ID Card Acquisition

We assist you in obtaining a national ID card, enabling you to fully enjoy the benefits and privileges of your second citizenship.

Driver’s Licence

We make it easy for you to obtain a driver’s license, providing a second form of identification and enhancing your mobility.

Adding Newborn to Your Citizenship

We expedite the process of securing a passport for your newborn, ensuring their citizenship is established quickly and efficiently.

Adding a Spouse & Additional Dependents

For an additional fee, we assist with adding your spouse, siblings, parents, or grandparents as dependents to your citizenship, helping you extend these benefits to your loved ones.

Citizenship enquiry